photo by Adobe Stock

By Diane Harris | Next Avenue

Buoyed by a sharp rise in stock prices that left many retirement savers feeling flush, the number of U.S. workers who say they’re confident about their ability to retire comfortably edged up last year, according to a sweeping new survey.

Sixty four percent of workers surveyed said they’re very or somewhat confident about their financial prospects in retirement, up from 60 percent in 2016. Confidence was even higher among those closest to quitting time: 71 percent of workers aged 55 and older professed confidence they’ll have enough money to live comfortably in retirement.

The big catch to this seemingly good news story: For many Americans, the faith in their ability to live well after they stop working full-time seems to be misplaced.

That’s my big takeaway from the 28th annual Retirement Confidence Survey, the country’s longest running look at the retirement prospects for workers and retirees. Conducted by the nonprofit Employee Benefit Research Institute (EBRI) with the research firm Greenwald & Associates, the survey reflects the expectations and experiences of more than 2,000 Americans aged 25 and older, roughly split between workers and retirees, who were polled online in January.

“There’s an incredible amount of overconfidence out there, based on erroneous assumptions about what life will be like after retirement,” says Jack VanDerhei, EBRI’s research director. “Many people may be in for an unexpectedly rough ride when the reality of retirement sets in.”

What the survey also makes clear: There are concrete steps you can take to avoid that fate and shore up your finances ahead of, or during, retirement.

With that in mind, here’s a look at the survey’s most important findings and advice for workers and retirees based on their implications:

Failing the Scout Test

American workers, particularly those 55+, won’t earn any merit badges when it comes to this critical tenet of retirement planning (and scouting): Be prepared.

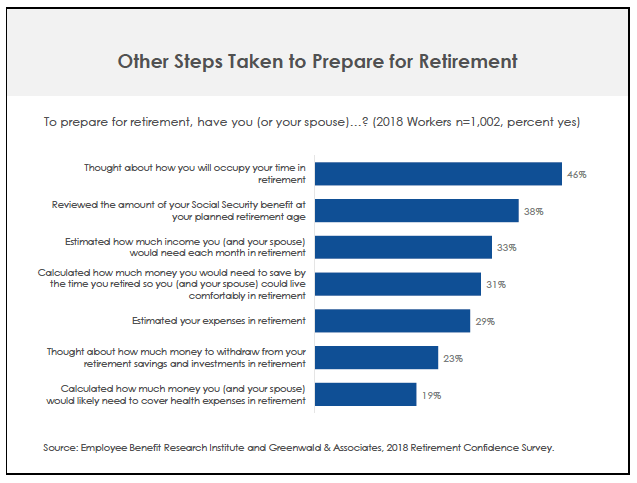

As the chart below shows, EBRI found that the majority of workers haven’t taken even the most basic steps to prepare for life after work, such as calculating how much they need to have saved to live comfortably, estimating what their expenses in retirement are likely to be or reviewing how much they’ll receive in Social Security benefits.

Older workers are more likely to have done some retirement prep than younger colleagues, as you’d expect, but not nearly enough, the survey showed. Only about half of the workers 55 and up had roughed out how much they’ll need to have saved, what their costs will likely be or how much monthly income they’ll need to cover those bills. Worse, just 37 percent had thought about how much to tap savings for living costs in retirement and a mere 28 percent had forecasted their estimated health care expenses.

If they’d run the numbers, says VanDerhei, “there’s no way in the world people would be so confident.”

That’s especially true given how little money many older workers have socked away for retirement.

EBRI found that 43 percent of workers 55 and older have less than $100,000 in savings and investments, and just 38 percent have $250,000 or more.

That low level of savings helps explain why the percentage of workers who are very confident about their retirement prospects (as opposed to the combined numbers for “very” and “somewhat” confident) are actually quite low. Only 17 percent said they were “very confident,” down from 18 percent a year ago.

What you can do: Take advantage of tools to help get a handle on what your expenses may be in retirement (such as this one from Vanguard) and how much you need to have saved by the time you quit full-time work (get a quick estimate here or a more in-depth analysis here).

Also, find out how much you’ll be entitled to in Social Security benefits based on your earnings record and anticipated retirement age from the handy calculators on the Social Security Administration website.

Expectations, Meet Reality

Another fascinating, if troubling, finding from the survey: The gap between workers’ expectationsabout retirement and retirees’ actual experiences is Grand Canyon-sized.

Take the age at which most Americans expect to exit their careers. Workers reported a median expected retirement age of 65, EBRI found. The actual median age reported by retirees: 62.

As for working past traditional retirement age, three in 10 workers surveyed said they expected to quit at 70 or later, but only 7 percent of retirees left the workforce that late.

Only one in 10 workers planned to retire before 60, but a stunning 35 percent of retirees actually did so, typically due to health issues or a layoff.

Workers also turned out to be poor predictors of where their money will likely come from in retirement. For instance, two-thirds of retirees said Social Security was a major source of their income, but that’s double the percentage of workers who thought this would be the case for them.

More than half of workers expect they’ll rely heavily on workplace savings accounts, such as 401(k)s, for their retirement income, yet only a quarter of retirees said these plans were a major source of income.

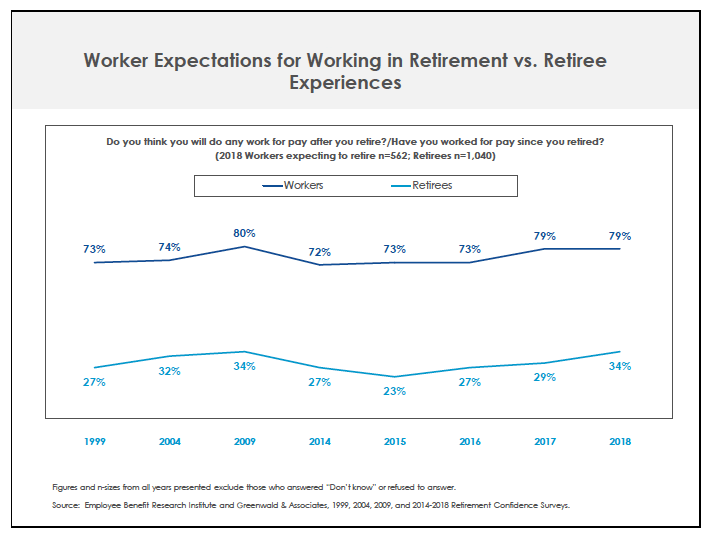

When it came to working in retirement, the divide was even greater, with 45 percentage points separating workers’ anticipation of a salary to supplement retirement income from retirees’ experiences working for pay (see the chart below) — 79 percent vs. 34 percent.

Still, the 34 percent who have brought home a paycheck in retirement represents a steady increase since 2015, when 23 percent did. While the uptick is noteworthy, VanDerhei says it’s a little premature to call it a trend because of the survey’s margin of error (just over three points) and because the percentage of retirees working hit the same mark in 2009 only to fall in subsequent years.

“It’s still very risky to assume the luxury of continuing to work will be your choice,” he says.

What you can do: If you’re still working, push yourself to bump up savings in your 401(k) or IRA, maxing out your contributions if possible, just in case the option is taken away from you sooner than you think. The 401(k) contribution limit in 2018 is $18,500; $24,500 if you’re 50 or older. The IRA contribution limit this year is $5,500; $6,500 if you’re 50 or older. “It’s so much easier to bite the bullet now and make higher contributions while you still can,” says VanDerhei.

Already retired? It’s okay to prudently tap workplace plans for income now —that’s why you saved the money. (A commonly recommended formula: Limit your withdrawal to 4 percent of your balance in Year One, then adjust that amount annually for inflation.)

Yet two-thirds of retirees aim to maintain or even increase these assets, the survey showed, suggesting they’re being ultracautious about spending. That echoes the findings of other recent research from EBRI and BlackRock.

“While it’s certainly better than spending down your assets too quickly,” says VanDerhei, “these numbers suggest many retirees may be living too stringently for their means.”

The Bogeyman: Health Care Costs

One area where the survey found worker’s confidence is especially low and retiree confidence is slipping: the ability to pay for medical and long-term-care expenses in retirement.

Forty six percent of workers said they aren’t sure they’ll have enough money to cover their medical bills and nearly six in 10 aren’t confident they could pay for long-term care if needed.

Seven in ten retirees are somewhat or very confident they’ll have enough money for health care expenses, and that’s down dramatically from 77 percent in 2017; just 16 percent are very confident they could pay for long- term care, vs. 20 percent last year.

Workers and retirees have good reason to be concerned: 44 percent of retirees told EBRI their health care bills were higher than anticipated and 26 percent said this about long-term care costs.

What can you expect to pay for health care in retirement? In another recent survey, Fidelity estimated that a typical 65-year-old couple who stop working this year will need $280,000 to cover their health care bills.

That $280,000 figure probably underestimates the health care tab for many retirees. For one thing, it doesn’t include long-term care bills, which, if incurred, typically tack on an extra $172,000 per person, according to research by PwC — and possibly many times more than that if an extended stay in a nursing home or assisted living facility is required.

“The number one thing that ends up wiping out a family who at retirement age looked like they were going to be in decent shape financially is long-term care costs,” VenDerhei says.

The millions of workers who retire before Medicare kicks in at 65 also face steeper-than-average costs. Fidelity found that more than a third of early retirees pay $500 a month or more in health care premiums alone. About half dip into savings to cover these and other out-of-pocket costs, such as co-pays and deductibles.

What you can do: Just getting an accurate handle on what your health care costs may be in retirement, using a tool such as AARP’s retirement health cost calculator, can be enormously helpful. EBRI found that respondents who estimated their health bills in advance were far more likely to say their actual ones were in line with their expectations than those who hadn’t.

It’s also a good idea to open a separate savings account specifically designated for health care expenses — either a Health Savings Account, if you have access to one at work, or an account you open and fund on your own.

As VanDerhei puts it, “Take control of the situations in your life that you can control now — such as creating a savings bucket for the health care bills you’ll inevitably face — and you’ll be in a much better situation later on.”

© Twin Cities Public Television - 2018. All rights reserved.

Read Next